INTRODUCTION

The Generic Drug User Fee Act (GDUFA) was signed into law on July 9, 2012, as a part of the Food and Drug Administration Safety and Innovation Act. The GDUFA is devised to ensure rapid delivery of safe and effective generic drugs to the American public and to improvise the predictability of the generic drug application review process. Fundamentally, the GDUFA enactment is based on the agreement negotiated between the United States Food and Drug Administration (USFDA) and the representatives of the generic drug industry to address the mounting regulatory challenges (FDA, 2015). The aim of the GDUFA is to support the FDA to ensure that participants in the U.S. generic drug system fulfill the quality principles to allow well-timed admittance of low cost and high-quality generic products. It correspondingly ensures that industry participants either foreign or domestic those who participate in the U.S. generic drug system, are to be consistent and are scrutinized every 2 years (Coates, 2015). The GDUFA enriches the FDA’s capability to safeguard the Americans in the intricate international supply environment by requiring the identification of facilities involved in the manufacture of generic drugs and active pharmaceutical ingredient (API) (Gaugh, 2015). Furthermore, the FDA’s communications and feedback with the generic industry is improvised to speed up the generic product entre in the U.S. commerce. The GDUFA essentially influenced the structuring and the growth of the Indian pharmaceutical market. Indian firms attained a significant level of approval rates of the Abbreviated New Drug Application (ANDA) in the U.S. market, thus creating India the prime FDA-accepted overseas generic drug producers. The ANDA approval rates have supported the progression of the export market in India. This helped in framing its ranking as the third prevalent exporter of the generic drugs in the form of capacity and 13th in terms of value by the end of 2017 (Patel, 2017).

Present picture of the pharmaceutical industry of India

The Indian pharmaceuticals market witnessed the development at a compound annual growth rate of 5.64%, during FY11-16, increasing from 20.95 to 27.57 billion U.S. dollars. The industry’s revenues are estimated to have grown by 7.4% in FY17 (IBEF, 2017). By 2020, India will be approaching one among the top three pharmaceutical markets by incremental advancement and sixth largest market globally in absolute size. In FY17, India exported pharmaceutical products of worth US$16.8 billion, with the number estimated to touch US$40 billion by 2020. Indian drugs are delivered to more than 200 nations worldwide, with the United States as a vital market (IBEF, 2017). The aim of this study is to assess the GDUFA and its repercussion on the Indian generic pharmaceutical industry. The comprehensive objectives were:

- To examine the benefits of the GDUFA to the Indian generic pharmaceutical industry against various challenges faced by the Indian industry post-GDUFA period.

- To analyze the economic effect of the GDUFA on the Indian generic pharmaceutical industry.

Before the implementation of the GDUFA, the pending ANDA applications, increased ANDA median approval time, under-sourced FDA staff with respect to ANDA submissions, and delay in conducting the FDA inspection of API and finished product sites remained the critical concern to the generic industry (Woodcock, 2016). After the execution of the GDUFA, it’s essential to evaluate the various aspects linked to it by collecting feedback from pharma professionals. Although the GDUFA is exerting an effect in the world’s generic pharma business; nonetheless, it is imperative to comprehend its impact on the several facets of Indian pharma business. Understanding the economic effect of the GDUFA on Indian generic businesses is important for the USFDA as well as the Indian generic industry, as future changes to the GDUFA through the negotiation procedure between the generic industry represented by India and the USFDA can be contemplated.

Methodology

The method used in this study was exclusive in nature. It includes the assessment of the perspective of targeted respondents, which hereby were the employed pharma professionals of India. Positivism was used as a research paradigm, wherein the researcher had collected the data through the survey conducted by using the questionnaire as a research tool (Cohen et al., 2007). Consent was obtained from the study participants for filling out the questionnaire. This research ensured the contributor’s privacy by providing the guarantee that the recognized data will not be assessed by any individual who is not explicitly involved in the examination. This study was a quantitative examination embracing large data sets obtained from the Indian pharmaceutical industry. The objectives of the research were met by adopting the quantifiable framework. The research approach followed was the deductive approach. The quantitative data therefore gathered were statistically analyzed to capture the explicit picture of the relationship possessed amongst the various variables associated with or influenced by the GDUFA. The simple random sampling technique was employed. The participants were randomly selected encompassing small, medium, and large pharmaceutical companies. This technique was used to avoid a bias while deciding the respondents. A sample size of 250 respondents from the various generic drugs and API-manufacturing companies were carefully chosen. The survey was conducted using a structured questionnaire. The survey questionnaire involved a total of five sections, out of that three sections are consistent with the main objectives of the study. Section A referred to the demographic information of the participants, section B was targeted to obtain data on the knowledge/consideration of the GDUFA. Section C included inquiries about the benefits of the GDUFA, section D included the various challenges faced by the Indian pharmaceutical companies due to the enforcement of the GDUFA, section E encompassed interrogations about the economic impact of the GDUFA, and lastly, section F covered other perspectives of the study partakers about the GDUFA. The data collected in this study were subjected to both the descriptive and inferential analyses, using the SPSS version 21.0 software package. Descriptive statistics involved frequency analysis which was symbolized by means of graphs and charts. Different inferential tests like regression, correlation, and Analysis of variance (ANOVA) were conducted to accomplish the results so that the inferences could be drawn for the study. The reliability of the data was tested using Cronbach’s α which was calculated to assess the consistency of the data collected using a rating scale, for example, Likert scale. Ethical considerations were taken into account by ensuring the study contributor’s privacy.

RESULTS AND DISCUSSION

Demographics like the background information of the participants and the influencing characteristics of the GDUFA were investigated through descriptive statistics. While, the views of the respondents about benefits, challenges, and level of the economic impact of the GDUFA on the Indian pharmaceutical industry were deliberated through inferential analysis.

Descriptive analysis

Descriptive analysis followed the frequency distribution which helped to segregate the responses of the participants and assess their general background information. The results obtained are summarized as follows.

Demographics

Area of functions—Responses from the Regulatory Affairs Department comprised 55% of the total population, followed by 27% from Research and development (R&D) departments. This is relevant to the main aim of the current study. Generally, the rules and regulations imposed on the pharmaceutical industry are looked after and its implementation is ensured by the Regulatory Affairs Department (Gummerus et al., 2016). Years of experience—Participants with 10–15 years of experience were in majority with 36.1% of the total participants followed by participants with 5–10 years of experience (26.4%), and subsequently followed by participants who are above 15 years of experience (20.8%). This distribution indicates that the respondent population had an enhanced knowledge about the implementation of the GDUFA which was attributed to their number of experience. Industry type—94.4% of the respondents belong to the generic drug manufacturing industry; however, only 5.4% of the respondents worked at API. Size of the organization—Survey findings indicated that the majority of the respondents (68.1%) belonged to the company which had an annual turnover of above Rs 300 Cr followed by 19.4% who belonged to companies with an annual turnover of Rs 100–300 Cr while 12.5% population had specified the annual turnover of Rs 9–100 Cr. The large chunk of pharmaceutical businesses in India represent multinational firms, therefore, these organizations have a turnover of above Rs 300 Cr (Khan and Khar, 2015).

Company location—Survey revealed that the (54.2%) respondents were from the western zone, followed by south (27.8%), and the lowest being north (6.9%). It is evident that the southern and western zones of India are the focal center of pharmaceutical manufacturing and in contrast to the pharma firms in the north and east (Mahajan and Bidkar, 2015) (Fig. 1).

Influencing characteristics of the GDUFA

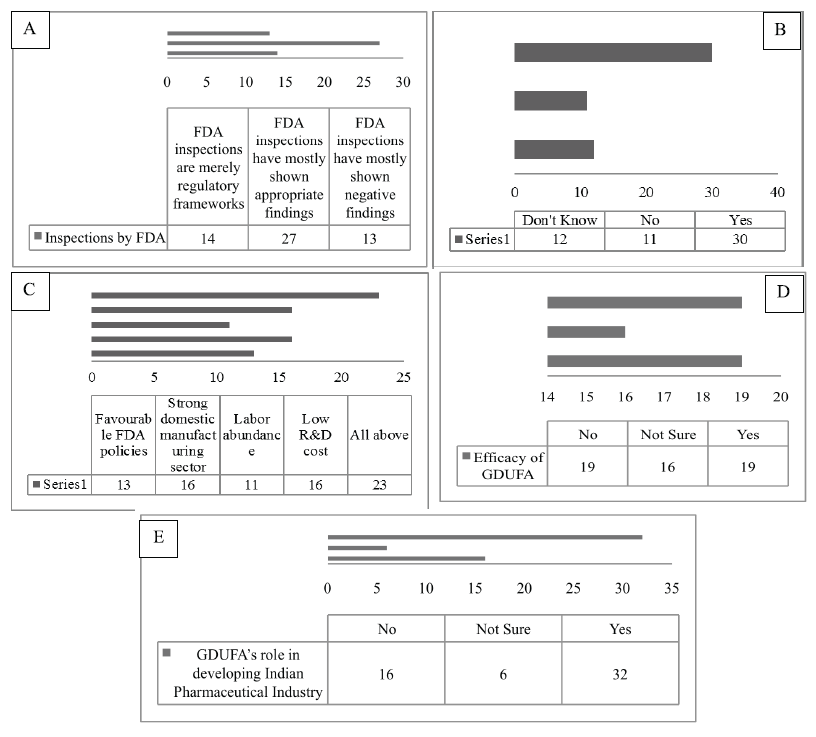

In this section, the various characteristics of the GDUFA were studied, which are summarized as follows; this study enclosed the opinion of the respondents on the inspections carried out by the USFDA in India. Where 50% of the respondents determined that during the post-GDUFA period, the findings of the FDA assessments are more appropriate. Nevertheless, 24.1% declared the reverse outcome and 25.9% believed that the FDA audits stand nothing but mere a regulatory programs. The FDA inspection process constructs alertness in the companies about the penalties for violating the laws (Kulkarni, 2017). Considering that the United States is a high-value market, companies are heavily dependent on the revenues from this lucrative market. Conversely, a slowdown in the profitability of the U.S. market significantly affects the growth of the firms. During the assessment of this feature, 56.6% of the respondents notified that with the inception of the GDUFA, the growth rate of the companies slows down distinctively. However, 20.8% of the respondents refused any sluggish growth due to the enforcement of the GDUFA. Remaining 22.6% of the population was not aware of the fact. The multinational companies with a broad range of products have a very minute effect due to the enactment of the GDUFA. However, companies pursuing only the generic drugs and also confronting difficulty in receiving the approvals may lead to the sluggish progress of the firm (Saini et al., 2014). It is necessary to evaluate, what are the factors responsible for providing a modest advantage to the Indian pharmaceutical industry during the Post-GDUFA era. In all, 29% of the respondents acknowledged that all the elements like favorable FDA policies, the robust local manufacturing sector, labor copiousness, and low R&D cost are all accountable in catering and acting as the competitive benefits to India. It was found that some of these factors provided the most competitive returns to the Indian pharmaceutical industry (Kotabe and Kothari, 2016). Hence, it can be inferred that the respondents had a better understanding of the aspects which acts as the competitive gain after the introduction of the GDUFA. However, 20% declared that only the strong local manufacturing sector is a vital factor, followed by 17% stating the favorable FDA policies whereas 14% stating the labor abundance in India as one of the crucial factors. Moreover, the respondents were questioned about their standpoints on the various fees included under the GDUFA in contrast to the benefits delivered. This helped to recognize the respondent’s outlook on the fees imposed under the GDUFA in proportionate to its various rewards. In this regard, the sample population was equally found, that is, 35.2% with the negative response while 35.2% with the positive response. It was stated that the GDUFA is absolutely reliable and efficient, the user fees which are both realistically priced and amenable to the several welfares provided (Dong et al., 2017). With respect to the respondent’s perceptions on the GDUFA’s role in the improvement of the Indian pharmaceutical industry to the world-class, the generic industry indicates that 59.3% of the participants believe that the GDUFA helped in reconditioning the Pharmaceutical Industry of India to a more international level industry. This means that the administration of the GDUFA is imperative for the companies to modify their operations and other functions to reach the global standards (Glessner, 2014). Solely, 29.6% of the respondents have displayed disparity to the 59.3% of the respondents’ view with a denial that GDUFA does not help in improving the conditions of the Indian pharmaceutical industry. Whereas 11.1% participants were not really sure about this aspect (Fig. 2).

| Figure 1. Frequency distribution for (A) the area of function, (B) years of experience, (C) industry type, (D) the size of the organization, and (E) respondent’s company location. [Click here to view] |

| Figure 2. Frequency distribution for (A) the perspective of opinion on inspections carried out by the FDA, (B) the respondent’s perspectives on the profitability and revenue growth, (C) the perspectives of the respondents on the factors producing the competitive advantage, (D) the respondent’s perspectives on the efficacy of the GDUFA fee over its benefit, and (E) respondent’s perspective on GDUFA’s role in developing. [Click here to view] |

Inferential analysis

The inferential analysis primarily included the correlations, regressions, and ANOVA statistics to address the research objectives.

Benefits against various challenges of the GDUFA

The dependent variable identified was the perspective of the pharma professionals on the GDUFA, whether it is more beneficial or more challenging. The independent variables with a p-value of less than 0.05 are considered to be statistically significant. As per correlation analysis in case of benefits, the independent variables like “the accelerated approval process under the GDUFA increases ANDA and Drug Master File (DMF) filings from India,” with Pearson correlation = 0.378 and p = 0.003; “GDUFA helps in ensuring the consistent and high-quality standards for drugs exporting from India” with Pearson correlation = 0.279 and p = 0.031 and “it would enable more transparency in the system” with Pearson correlation = 0.342 and p = 0.008. This implies that these three variables found were most beneficial. The hypothesis developed for variable benefits were

| Table 1. Correlation statistics for the benefits of the GDUFA. [Click here to view] |

H1: Benefits of the GDUFA are more than the challenges after its implementation to the Indian pharmaceutical industry.

H0: Benefits of the GDUFA are less than the challenges after its implementation to the Indian pharmaceutical industry (Table 1).

ANOVA statistics reveals that R2 is 0.340 or 34% and the adjusted R2 is 0.249% or 24.9%, implying that for every benefit of the GDUFA various challenges did not hamper the industry. Moreover, the F-value is 3.746 with the significance value of 0.002 (<0.05), indicating that the null hypothesis can be rejected and thereby the benefits of the GDUFA were found greater than the challenges (Table 2).

According to the regression statistics “accelerated approval process under the GDUFA increases ANDA and DMF filings from India,” “the GDUFA challenges encourage Indian companies to file complex generic drug products,” and “as a result of the GDUFA, the managerial modifications, and other technical improvements are required in the organization” showed the higher t values and significant p-values of 0.037, 0.028, and 0.048, respectively. Hence, the null hypothesis was rejected (Table 3).

| Table 2. ANOVA statistics for the benefits of the GDUFA. [Click here to view] |

| Table 3. Summary of regression analysis of the benefits of the GDUFA. [Click here to view] |

| Table 4. Correlation analysis for the challenges by the GDUFA. [Click here to view] |

| Table 5. ANOVA statistics for challenges that divert the market focus of pharma companies. [Click here to view] |

Emotive aspects of the GDUFA

The two independent variables have shown a significant p-value and Pearson correlation value indicated that these factors were the main challenges of the GDUFA. The independent variables like, “the United States entry of small medium enterprises (SME’s) is restricted due to the GDUFA fees” with p = 0.001 and Pearson correlation = −0.423 and “the various GDUFA challenges discourage Indian companies from filing in the U.S. market” with p = 0.000 and Pearson correlation = −0.464. Here, the negative correlation shows that if one value increases then the other will decrease. The hypothesis developed for the variable challenge was

H2: Challenges from the GDUFA will not shift the focus of the industry to the other market.

H0: Challenges from the GDUFA will shift the focus of the industry to the other market (Table 4).

ANOVA statistics for the challenges of the GDUFA diverting the market focus of the Indian pharma companies have shown that R2 = 0.345% or 34.5% and value of adjusted R2 = 0.263% or 26.3%, indicated that for every challenge of the GDUFA the companies would not divert to the other market. The adjusted R2 indicated that the percentage of variation explained only by the independent variable that indeed affects the dependent variable. The F-value was found to be 4.219 with the significance of 0.002, implying that the null hypothesis can be rejected (Table 5).

Regression analysis for the challenges distracting the main focus of the company to another market, all the variables had p-value greater than 0.05 except, “the various GDUFA challenges that prevent the Indian companies from filing in the U.S. market” with p = 0.008 and t statistics = −2.755. The negative t statistical values indicate the low potential of influencing the pharmaceutical generic industry from diverting to the other market due to the challenges of the GDUFA. The null hypothesis was rejected and the alternative hypothesis was accepted. Therefore, it can be concluded that even with the challenges in the GDUFA the generic pharmaceutical industry would not divert their focus to the other market (Table 6).

| Table 6. Summary of regression analysis for challenges that divert the market focus of the industry. [Click here to view] |

| Table 7. Correlation analysis of the economic impact on the industry. [Click here to view] |

| Table 8. ANOVA statistics for the economic change in the pharmaceutical industry. [Click here to view] |

| Table 9. Summary of regression analysis for the economic impact. [Click here to view] |

Economic impact of the GDUFA

The dependent variable identified was the overall effect of the GDUFA on the return on investments (ROI) where independent variables were the factors that hamper the economic stability of the Pharmaceutical generic industry.

Correlation analysis of the economic impact on the industry indicated that most of the correlation was negative implying that with the increase in the dependent variable, the reliability of the independent variable will decrease distinctively. The factors like, “increased FDA inspections of the Indian firm leads to an increase in credibility in public view,” “increasing effectiveness and efficiency of the generic firm by increasing FDA inspection,” and “FDA inspection as a burden for small-scale firms” have shown the negative correlation −0.120, −0.092, and −0.101, respectively. Although, it can be seen that none of the factors of the economic aspect provided the significant impact of the GDUFA on ROI as all had the poor significance of p > 0.05. The hypothesis developed for variable an economic impact was

H3: The overall impact of the GDUFA on ROI for the Indian pharmaceutical industry had increased.

H0: The overall impact of the GDUFA on ROI for the Indian pharmaceutical industry had decreased (Table 7).

Regression analysis results have shown that the R2 was 0.147 or 14.7% and adjusted R2 was 0.031% or 3.1%. The F-value was 1.271 which is very low with the significance of 0.297. This indicates that the null hypothesis can be accepted (Table 8).

Again to confirm the acceptance of the null hypothesis, the coefficient of a regression performed which indicated that “FDA inspections act as a burden for small-scale firms” was the only factor that showed p = 0.048 (<0.05). Moreover, the t statistic was also found to be −2.047, indicating a low potential of influencing the decreased economy of the Indian pharmaceutical industry. In this manner, it was evident that the null hypothesis can be rejected as at least one of the independent variable had p < 0.05, even when all other variable had p > 0.05 (Table 9).

CONCLUSION

To evaluate the effect of the GDUFA, three aspects were studied which includes benefits, challenges posed due to the implementation of the GDUFA, and its overall impact of the GDUFA on ROI. The primary analysis collaborates with a statistical significance of the GDUFA to Indian generic drug sector. By employing various statistical analysis like correlation, ANOVA, and regression analysis, it was found that the benefits from the GDUFA were greater than the challenges. However, the existing challenges do not influence the focus of Pharmaceutical companies on the other market. Lastly, it was also found that the GDUFA had helped in increasing the volumes of generic drug manufacturing and export globally. The implementation of the GDUFA had positively influenced the economy of the Indian pharmaceutical industry. Thus, it can be implicated that the GDUFA has a significant positive effect on the Indian pharmaceutical industry and the country’s economy. It can also be concluded that the GDUFA implementation helps in bringing all the Pharmaceutical companies in compliance with the USFDA and equally to practice good regulations of manufacturing and marketing of the generic drugs, therefore the increased performance is seen.

Recommendations and future scope

- The Pharmaceutical Industry must keep on escalating its export rate of the generic drugs by using its resources and maintaining compliance with the regulations of the USFDA.

- The managers and the administrators must work on spreading awareness, knowledge, the importance of the GDUFA, and its strategic objectives of how they are helpful in impacting the economy.

- Another recommendation is that the challenges of the GDUFA enactment must be well known for their significance and consequences.

- Lastly, it is recommended that the employees and the company must scrutinize their operations to ensure that they are in compliance all the time.

In the view of the author, the future scope can be extended to a broader range of individuals and companies for the survey analysis, to obtain a more substantial view on the significance of the GDUFA implementation within the industry. The sample size can be increased to make the generalization of the research. Furthermore, the analysis of the post-implementation of GDUFA-I and GDUFA-II may also be compared extensively. Lastly, in-depth qualitative studies, in the form of interviews, can be conducted with a senior official from the Pharmaceutical Industry policymakers as well as the FDA officials to determine the fundamental factors that can assist the Indian pharmaceutical industry to gain the significant advantages from the GDUFA.

CONFLICT OF INTEREST

The author has no conflict of interest to declare.

REFERENCES

Coates M. Industry and FDA overview on GDUFA: Where have we been, where are we now and what is next? 2015 [Online]. Available via https://www.fda.gov/ForIndustry/UserFees/GenericDrugUserFees/ucm318042.htm (Accessed 5 November 2015).

Cohen L, Manion L, Morrison K. Strategies for data collection and researching: Questionnaire. In: Research methods in education. 6th edition. Routledge, Abingdon, United Kingdom, pp 317–46, 2007. CrossRef

Dong K, Boehm G, Zheng Q. Economic impacts of the generic drug user fee act fee structure. Value in health. J Int Soc Pharm Outcomes Res, 2017; 20:792–8.

FDA. Generic drug user fee amendments: GDUFA legislation. 2015 [Online]. Available via https://www.fda.gov/forindustry/userfees/genericdruguserfees/ucm337385.htm (Accessed 20 October 2017).

Gaugh D. GDUFA Past and present. 2015 [Online]. Available via http://www.gphaonline.org/media/cms/GDUFA_Public_Meeting_PPT_6.15.15.pdf (Accessed 07 January 2016).

Glessner M. GDUFA’s impact on the API industry –an update. 2014 [Online]. Available via http://www.chemanager-online.com (Accessed 10 December 2017).

Gummerus A, Airaksinen M, Bengtström M, Juppo A. Outsourcing of regulatory affairs tasks in pharmaceutical companies—Why and what? J Pharm Innov, 2016; 11:46–52. CrossRef

IBEF. Pharmaceuticals. 2017 [Online]. Available via https://www.ibef.org/download/Pharmaceutical January-2017-D.PDF (Accessed 5 April 2018).

Khan AN, Khar RK. Current scenario of spurious and substandard medicines in India: a systematic review. Indian J Pharm Sci, 2015; 77:2–7. CrossRef

Kotabe M, Kothari T. Emerging market multinational companies evolutionary paths to building a competitive advantage from emerging markets to developed countries. J World Business, 2016; 51:729–43. CrossRef

Kulkarni N. Warning letters and Indian pharma. 2017 [Online]. Available via https://www.biospectrumindia.com/features/69/9283/warning-letters-and-indian-pharma.html (Accessed 11 February 2018).

Mahajan R, Bidkar N. Managing growth through better compliance management: a survey report. 2015 [Online]. Available via https://www2.deloitte.com/content/dam/Deloitte/in/Documents/finance/in-fa-pharma-survey report-noexp.pdf (Accessed 8 March 2016).

Patel D. The resurgence of pharma sector in India. Express Pharma News, 2017; 13:35–9.

Saini M, Tripathy S, Dureja H. USA FDA’s implementation of QbD and GDUFA: a wakeup call for other regulatory agencies across the globe. J Med Market, 2014; 14:108–14. CrossRef

Woodcock J. Implementation of the generic drug user fee amendments of 2012 (GDUFA). 2016 [Online]. Available via https://www.fda.gov/newsevents/testimony/ucm484304.htm (Accessed 15 January 2016).